PMEGP stands for the Prime Minister’s Employment Generation Programme. This scheme was launched in 2008 during the UPA government’s regime. The PMEGP is a credit-linked subsidy scheme that is administered by the Ministry of Micro, Small and Medium business enterprises

PMEGP

PMEGP is a merger of two schemes, first the Prime Minister’s Rojgar Yojna and Second, Rural Employment Generation Programme. Currently, this programme implemented at a national level, under the Khadi and Village Industries Commission (KVIC). Whereas on a State level, it implemented by the State Khadi and Village Industries Commission Directorate, State Khadi and Village Industries Board and District industries, Centres and banks.

The objective of PM EGP

The main focus of this programme is to generate self-employment opportunities through micro-enterprise establishments, in the non-farming sector. It aims to help Unemployed youth and traditional artisans.

This scheme especially helpful during this pandemic when unemployment is on an all-time rise and MSMEs have been affected badly owing to the unplanned lockdowns. The role of banks in this scheme also leads to higher credit flow to the micro sector.

Eligibility For PMEGP

The criteria for eligibility for benefitting from this scheme are as follows

- The applicant should be 18 years of age or more.

- Minimum education should be passing VIII standard, for a project above Rs 5 lakh in the service sector and above Rs 10 lakh in the Manufacturing Sector.

- Institutions applying should register under the Societies Registration Act 1860.

- Production-based Co-operative societies.

- Self-help groups and Charitable Trusts.

Any pre-existing units (under PMRY, REGP or any other centre or state government scheme) or any Units, who have already availed a Government subsidy under any of the Central or State government’s scheme, are NOT eligible for application.

Features Of PMEGP scheme

- The maximum cost for projects is 25 lakhs in the Manufacturing sector and 10 lakh in the Business/Service sector.

- The per capita investment under the scheme should not exceed Rs 1 lakhs in plain areas and Rs 1.5 lakh in Hilly areas.

- According to the Khadi and Village Industries Commission Act of 2006, under this scheme, the rural area comprises places where the population not more than 20 thousand, whereas in Urban areas only District Industries Centre included.

- The margin money, e. the leftover percentage of the money that not financed by the bank, 5% for Special borrowers and 10% for General Borrowers.

- The normal rate of interest applied from time to time on the enterprise.

- The loan Repayment schedule ranges from 3 to 7 years.

- All the trainees have to undergo a mandatory 2 week training period.

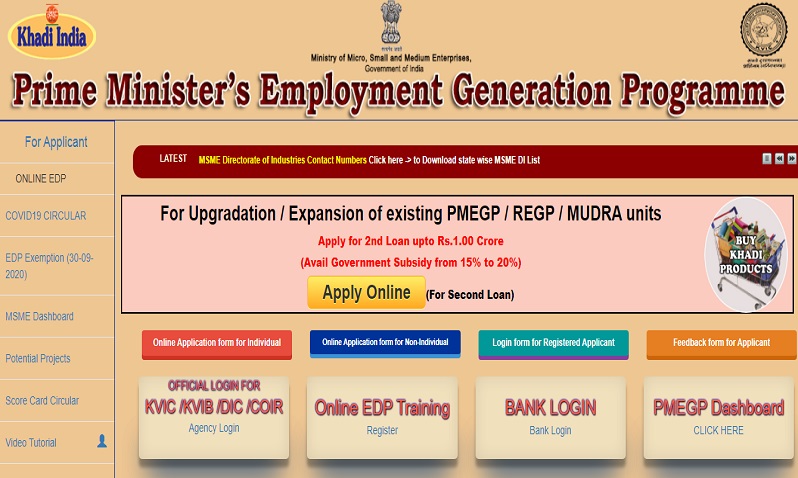

PMEGP Application Form

For online application, the applicant can first visit the official website for the Khadi and Village Industries Commission (KVIC). From there the PMEGP e portal will direct the applicant to the application form, which can be filled in, saved as a draft and then the physical copy submitted to the nearest office.

The location of the offices advertised in newspapers by the State/Divisional Directors of KVIC and Director of industries of the respective states. All the related formalities performed at the respective bank.

Documents required for PM EGP application

To get Eligible and completely prepared for the application procedure, the following documents should be prepared beforehand:

- Project Report

- Caste Certificate

- Special Category Certificate

- Rural Area Certificate

- Education/Skill Development training Certificate

Subsidies provided By PMEGP Subsidy Scheme

General Category – The eligible subsidy is 25% of the cost of the project in rural areas and 15% in urban areas. For more updates and other information check Timesalert.

Special Category – The eligible subsidy is 35% of the cost of the project in rural areas and 25% in urban areas.

List of Activities not allowed under PMEGP

- Industries/Businesses connected with producing/processing of intoxicating items such as Bidi, pan, Cigar, Cigarette etc.

- Manufacture of less than twenty-micron thickness polythene carries bags or containers manufactured out of recycled plastic, any other item that harms the environment.

- Industries like processing of Pashmina wool.

- Products like hand spinning and hand weaving, which take advantage of the Khadi Programme.

- Rural Transport. However, House Boats, Tourist Boats and Cycle Rickshaws may be permitted in Andaman & Nicobar Islands and J&K.

- Cultivation of crops/plantations like Rubber, Tea, Coffee, etc.

- Sericulture (Cocoon rearing), Horticulture, Floriculture, Animal Husbandry like Pisciculture, Piggery, Poultry, Harvester machines etc. are also not eligible under PMEGP.

FAQs On PMEGP

What is Margin Money in PMEGP?

Margin money refers to the subsidy that the applicant gets from the Khadi and Village Industries Commission. It is the amount of money the government invests in the business. The margin money given to the bank and has a lock-in period of 3 years.

What is the EPD training?

EDP is the Entrepreneurship Development Programme for the PMEGP beneficiaries. It helps to motivate, inspire, and build confidence and capacity for the establishment of an enterprise.

What do the components of Project cost?

Project cost comprises Capital expenditure loan, One cycle of working capital, 10% of the project cost as own contribution for General category and 5% for Special Category.

Which are the approved financial agencies?

Public Sector Banks, Regional Rural Banks, Co-Operative Banks, Private scheduled commercial banks that approved by the State Taskforce committee.

Contents