Online banking is a facility offered by banks and financial institutions that allow customers to use banking services with the help of the internet. There are various payment and settlement systems in India. That made the method of transferring money from one bank account to another very easier and faster.

Now, every bank, private companies, and government bodies were using different payment methods. That helps the customer and bank entities to work smoothly.

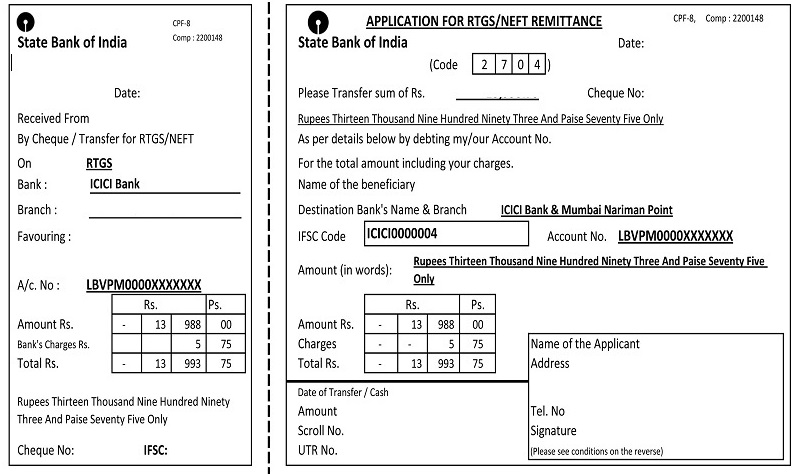

SBI RTGS Form PDF 2024

Today the customers don’t have to wait for days to receive money in their bank accounts online banking has made this easier. Money is sent and received in very little time, with the help of this online payment system.

There are different method used in India for fund transfer, but the most commonly used online fund transfer methods were

- Real-Time Gross Settlement (RTGS)

- National Electronic Funds Transfer (NEFT)

SBI offers Real Time Gross Settlement (RTGS) and National Electronic Fund Transfer system (NEFT). It allows an efficient, secure, economical, and reliable system of transfer of funds. It enables fund transfer from bank to bank as well as from remitter’s account in a particular bank to the beneficiary’s account in another bank across the country.

SBI RTGS Form Download

RTGS stands for Real-Time Gross Settlement (RTGS). It is an electronic payment system where payment instructions between banks are processed and settled individually and continuously on a real-time basis. And it is available for a transaction value of only Rs.2.00 lacs and above.

SBI NEFT Form Download

NEFT stands for National Electronic Funds Transfer. NEFT also an electronic payment system where payment instructions between banks processed but settled on a deferred net settlement (DNS) basis at fixed times during the day. Also in NEFT, there is no minimum transaction value claimed for using this facility.

How To Fill SBI RTGS/NEFT forms

SBI RTGS, the Fastest Interbank Fund Transfer System in our Country. In RTGS all the Transactions Processed Continuously throughout the Working Hour of SBI. While NEFT operates on Deferred Settlement Basis, every transaction done through NEFT Processed in Batches.

The RTGS/ NEFT forms need to be filled for the process. To fill the RTGS/NEFT form follow the below steps:

- There are two sections in RTGS/NEFT form, the left section is for a customer to fill their details and the right section is for the bank to fill details.

- The customer has to fill information like Sender Account Details, Beneficiary Account Details, Beneficiary Bank IFSC Code, and the Amount needed to transfer in the form while sending RTGS/NEFT.

- The form’s right Section will be filled by the bank after completing the transaction where they will mention the transaction id and other details there.

- Note that for RTGS amount should be greater than Rs. 2, 00,000.

Required information To transfer Funds

- Amount Transfer

- Beneficiary Account number

- Name of the beneficiary bank

- Name of the beneficiary customer

- Account no. of the beneficiary customer

- IFSC code of the Beneficiary Bank branch

How to use SBI RTGS/NEFT services online

To use RTGS/NEFT services online follow the below steps given:

- You need to avail Internet Banking facility for your account with transaction rights. You can contact your SBI branch for the same.

- Visit the official portal of SBI online and log on to the official website

- using Internet Banking ID and Password.

- Select the Profile option and click on the Manage Beneficiary link.

- Now click here Inter Bank Payee from the options provided.

- Now, select the ‘Add’ option and provide the Beneficiary Name, Beneficiary Account Number, Address, and Inter-Bank Transfer Limit in the required fields.

- Enter the IFSC code of the beneficiary bank branch by selecting the IFSC code option and entering an 11 digit IFSC code in the given box. Or you can select the Location option and then the Beneficiary Bank, State,, and Branch from the drop-down menus provided.

- Click on the “accept Terms of Service” button and click on the “confirm” button.

- A high-security password sent to the mobile number. Now enter this password to authorize the beneficiary.

- Note, the beneficiary added activated in a maximum of 16 hrs time. And once activated you can transfer funds to the beneficiary.

- You can remit funds to the Inter-Bank Payee through RTGS/NEFT by selecting the “Inter Bank Transfer” link in the “Payments/Transfers” option.

- Next, select the Transaction Type-RTGS or NEFT. The list of beneficiary accounts added will appear.

- Now, you have to enter the amount and select the beneficiary to be credited from the list.

- Then click on the “accept Terms & Conditions” button and later click confirm. For other updates check Timesalert.

Benefits of RTGS/NEFT services

- SBI RTGS said to be the safe and Secure Systems of Fund Transfer.

- There is No Amount CAP in RTGS.

- The Beneficiary Account Gets the Fund in Real-Time.

- By using SBI Internet Banking you can access RTGS Services.

- SBI RTGS service has the Legal Backing of all the Transactions

- You don’t have to Visit the Branch for SBI RTGS Form PDF Submission.

- RTGS Transactions Charges capped by RBI.

Conclusion

SBI offers different banking services, which include online transactions and fund transfer using RTGS/NEFT services. The services are also available offline; customers can visit the bank and follow all the formality. RTGS AND NEFT provide an efficient, secure, economical, and reliable system of transfer of funds from bank to bank as well as from remitter’s account in a particular bank to the beneficiary’s account in another bank.

Contents