Axis Bank offers various internet banking facilities that help and ease the banking experience of the Axis Bank customers. Online banking allows customers to do most of their banking processes online at their convenience. Axis bank provides a secure and smooth online fund transfer anywhere and anytime.

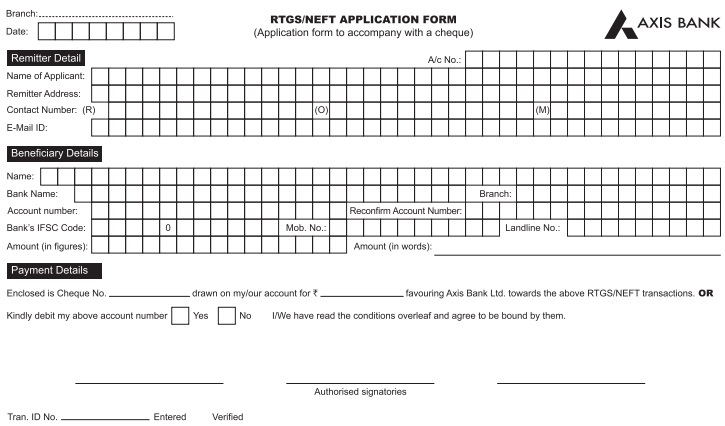

Axis Bank RTGS Form PDF

There are various payment and settlement systems in India which have made the method of transferring fund from one bank account to another very simple and faster. Fund transferring has become an easy task with technology becoming a major part of our day-to-day lives. The most commonly used online fund transfer methods are RTGS and NEFT.

Axis bank provides Real Time Gross Settlement (RTGS) and National Electronic Fund Transfer system (NEFT) services to their entire bank account holder. This service ensures an efficient, secure, economical, and reliable system of transfer of funds. It enables fund transfer from bank to bank as well as from remitter’s account in a particular bank to the beneficiary’s account in another bank across the country.

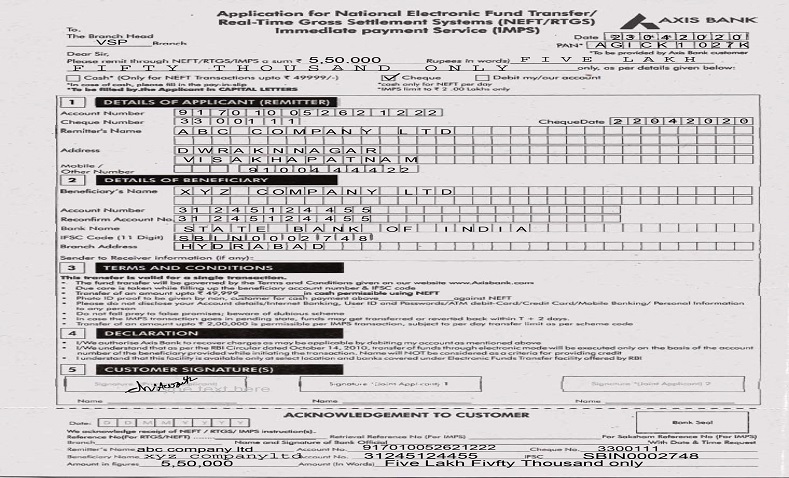

Axis Bank RTGS and NEFT Form

RTGS abbreviated as Real-time gross settlement systems. RTGS is an electronic payment system where payment instructions between banks are processed and settled individually and continuously on a real-time basis. Gross Settlement implies to the settlement of funds transfer instructions occurs individually (on an instruction by instruction basis). RTGS is meant for large value transactions and is available for a transaction value of Rs.2.00 lacs and above.

NEFT stands for National Electronic Fund Transfer. It is a quick and fast way of transferring funds from a particular bank to any other bank that is a participant in this scheme. NEFT transaction is now up for 24×7 with 48 half-hourly batches. Axis Bank will process all inward transactions 24×7.

Also in NEFT, there is no minimum or maximum limit on the number of funds that cou006Cd be transferred.

Axis bank RTGS timing

The transfer timings for RTGS are Monday to Friday from 10 am to 3:30 pm, and Saturdays excluding the 2nd and 4th Saturday.

Axis bank NEFT timing

The transfer timing for NEFT is Monday to Friday from 10 am to 4:30 pm, and Saturdays excluding the 2nd and 4th Saturday.

Fill Axis bank RTGS and NEFT Form

Most of the Indian banks allow RTGS money transfer at the bank branch, on their website, or the mobile app. Also, it is now available in a pdf format so that the customer can print the form, fill it up and submit it at the bank branch.

The RTGS/ NEFT forms need to be filled to access the services. To fill the RTGS/NEFT form follow the below steps:

- There are two sections in the axis bank RTGS form, on the top section customer has to fill the beneficiary details, and on the bottom section fill remitter details

- Make sure that the information filled such as sender account details, beneficiary account details, beneficiary bank IFSC code, and the amount to transfer are correct, before sending the RTGS form.

- Check the details correctly. The bank will “branch use the only” section after completing the transaction, the customer will get a transaction id.

- Note that the Axis bank RTGS services transfer amount should be above Rs.2, 00,000. For more details and information check Timesalert.

Axis bank RTGS Services

- Axis Bank offers RTGS form in both pdf and an editable format, and both English and Hindi language.

- The Bank has made easy and hassle-free RTGS money transfer for its account holders.

- Axis bank also permits payments by cash or cheque.

- All the transaction is processed continuously on a transaction basis in RTGS.

Information required for transfer of Funds

- Amount to be transfer

- Beneficiary Account number

- Name of the beneficiary bank

- Name of the beneficiary customer

- Account no. of the beneficiary customer

- IFSC code of the Beneficiary Bank branch

Conclusion

Axis bank provides different banking services, which include online transactions and fund transfer using RTGS and NEFT services. The services are also available offline and in pdf format. RTGS AND NEFT provide an efficient, economical, secure, and reliable system of transfer of funds from bank to bank as well as from remitter’s account in a particular bank to the beneficiary’s account in another bank. Axis bank offers a secure and smooth online fund transfer from anywhere and anytime.

Contents