Many customers face problems with the bank official and they report complaints to the bank. But, unfortunately, sometimes the grievances remain unresolved. If the bank doesn’t take any action regarding the customer’s problem, they can lodge complaints to the banking ombudsman.

Banking Ombudsman

In India, all the banks work under the Reserve bank of India (RBI). RBI gives direction to other banks and helps in the banking system. Also, RBI is responsible for clearing customer’s grievances, if they face any problem with the concerned bank.

RBI has introduced a banking ombudsman system, where customers complain grievances if the banks don’t respond to their problems. A banking ombudsman meaning is an authority introduced to resolve the complaint of customers. It is a quasi-judicial authority introduced by the government of India.

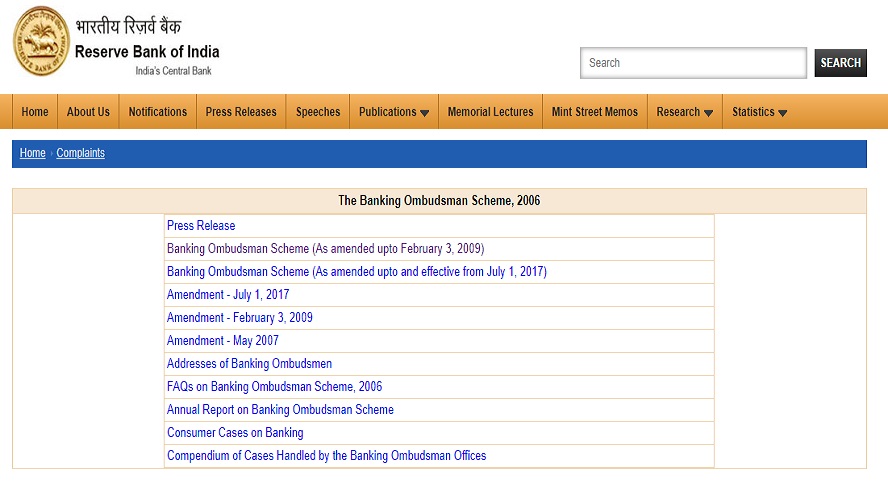

The banking ombudsman scheme was introduced in 1995 in India and was revised in 2002. Now the 2002 scheme is replaced by the new 2006 scheme. The authority is now operated under the banking ombudsman 2006 scheme.

Note, one cannot file a complaint directly to the banking ombudsman. Customers first have to report grievances to their concerned bank. If in case the bank doesn’t respond and resolve problems, then the customer can proceed to the bank ombudsman.

How to file a complaint At Banking Ombudsman

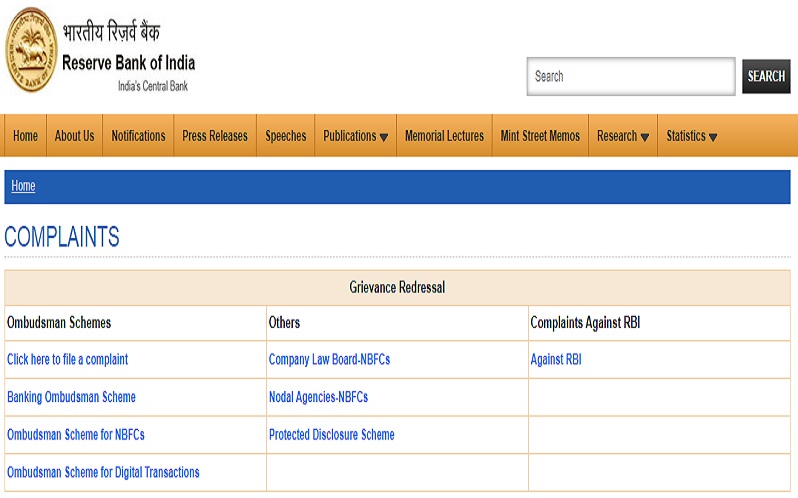

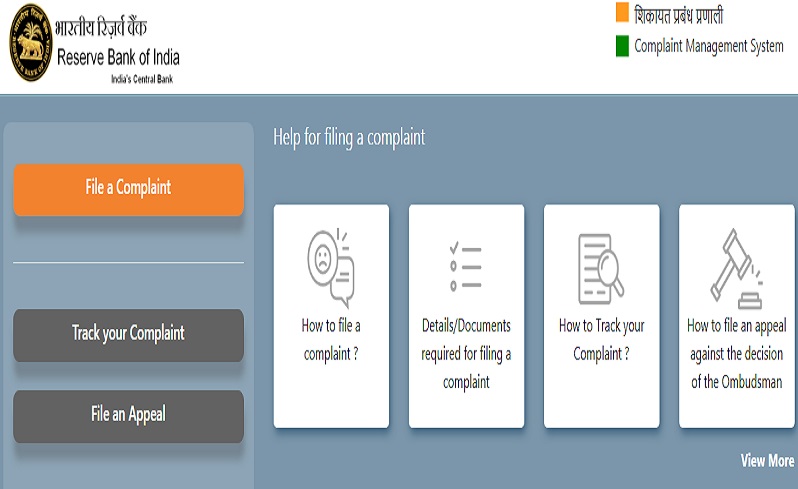

You can file a banking ombudsman complaint easily from the website of RBI. You can complain if your bank hasn’t responded within one month from the date of the complaint. Also, if the bank has rejected your complaint or you are not satisfied with the answer, you can complain. To file a complaint with the Banking ombudsman follow the below steps

- Go to the official website of RBI

- The website’s homepage appears on the screen, now select the “file complaint” option.

- Go to the menu option and select the location of the BO office according to your complaint.

- And now, select the bank branch. Fill the complaint described in the required field, and click on the submit button.

- The system will send you a reference number. Tap on it to download the figure in pdf for future reference.

- After the complaint has lodged, the Banking Ombudsman will check the matter.

- The banking ombudsman personnel will look into it and will try to resolve it within 30 days.

How to file a complaint To RBI Ombudsman by email

Customers can now file a complaint by using the email service. One can send an email to the ombudsman system for any grievance. Customers can email through banking ombudsman email id

- https://www.rbi.org.in/commonman/English/Scripts/AgainstBankABO.aspx.

The banking ombudsman personnel will look into the matter and check the relevant facts and documents. And then they will try to resolve the problem. If in case, the customer feels that the decision is unsatisfying, they can further go to consumer court. For more other information and updates check Timesalert.

Check Banking Ombudsman Online complaint status

You can track your banking ombudsman complaint form by the RBI online web portal. Follow the below steps to track complaint:

- Visit the official page

- On the website’s homepage, you will see the “track your complaint” option, click on it.

- After that, you redirected to a new page.

- On the new page, enter your complaint number.

- Next, you enter the given “Captcha Code” in the required field.

- Now, recheck and click on the submit button

Requirements to file a complaint at Ombudsman

Customers have to visit the office of the concerned ombudsman with the required details to file complaint. Following details required to file a complaint:

- Applicants name, postal address along with phone number and email address.

- Name and address of bank/branch/entity or office

- Account number or card number if there is any card related complaint.

- Facts of loss caused and the relief sought thereof.

- Documents related to the case if applicants have any.

Eligible complaints that filed with the banking ombudsman

Every complaint not considered, there were certain rules one should follow. One can complain concerning the following banking services

- Non-payment or unusual delay in the payment /collection or issue of cheques, drafts, bills, etc.

- Non-acceptance, if the cause is not sufficient or cause small denomination notes and coins tendered for any purpose.

- Nonpayment or delay in payment of inward remittances and non-adherence to prescribed working hours by the bank.

- If any delay or failure occurs in providing any banking facility (other than loans and advances) promised by the Bank.

- If the open deposit accounts refused without any valid reason and levying charge without any notice.

- Non-adherence to RBI instruction concerning mobile banking or electronic banking services

- Nondisbursement of pension funds or any delay of the services.

- Non-adherence to RBI instructions on ATM / Debit Card or other prepaid card operations in India.

- Refusing to close or delay in closing accounts. By not following the fair practice codes

- Non- acceptance of an application for loans doesn’t give valid reasons to the applicants.

- Not observing Reserve Bank guidelines on the engagement of recovery agents by banks.

- Sanction delay disbursement of the prescribed schedule for disposal of loan applications by the bank.

Conclusion

A banking ombudsman an authority created to resolve complaints of the customers of the bank. If the customer is unhappy with the services they can file a grievance with the RBI ombudsman. Customers can file the banking ombudsman online complaint through the RBI portal. But before complaining to the ombudsman, customers should have a complaint to their concerned bank.

Contents