BBMP Property Tax is the Online Portal that will help the citizens to pay the property taxes quickly from the online. Property tax is by the state government for real estates in the Urban Bodies. BBMP is responsible for collecting the Karnataka state property tax. The calculation of the property tax based upon the unit area system. The value depends on different things like location, area, and usage of the property. BBMP will help you in every process and Paying the Property Tax through online means. In this article, we will give you complete information about the BBMP Property Tax Online Payment, Status Check through the online process.

BBMP Property Tax

We need to pay the property taxes of a state in a given due time, or else you will subject for late fine. The BBMP Property Tax is an easy and straightforward way to make the payments. It is the best way to pay you property tax of the Karnataka state and the online portal is very user-friendly. The BBMP tax property is the funds to maintain public roads, parks, and many general features. The tax money will help with running civic duties smoothly and efficiently. So, it is necessary to pay the BBMP property tax online.

Bruhat Bengaluru Mahanagara Palike will take care of the BBMP property tax collection through online. We can pay the bills in cashless form using the net banking or other option given by them. We can check the payment status, calculate the property tax, and download the receipt and Challans. If you have new property to pay, then you can easily use the online portal for the information and other details by giving your application number. So, all this information discussed in the below article.

How Is BBMP Property Tax Calculated

The property tax calculated in three different ways given here. They are the Annual Rental Value System, the capital Value system, or the Unite value system. The Karnataka State follows the Unit Area System to assign the property tax.

Unit Area System: According to this, the tax charged is the per-unit price of the carpet area. The property value will have to multiply with its carpet area to determine the tax applicable for it.

We can calculate the tax amount for our property through an online web portal. The site allows you to check the tax before paying the amount. The BBMP Property Tax has tax calculation steps given below.

- Open the home page of BBMP Property Tax or give the URL bbmptax.karnataka.gov.in on the search box.

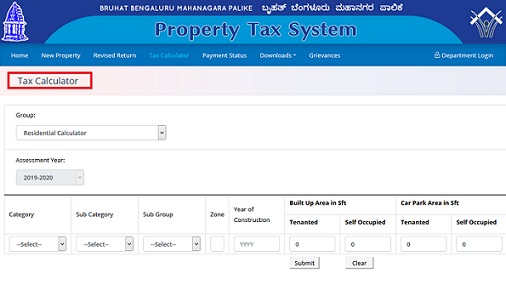

- In the menu options on the top of the page, you can see the possibility of Tax Calculator and tap on it.

- Now you can see the text fields to give the details on the window.

- Select the group forms the drop list on the page and Assessment Year and categories on the web page.

- Give the year of construction and Built-Up area in Sft and Car parking area in Sft in the box assigned for them.

- Tap on Submit option on the below screen, and this will display your tax amount and complete details on display.

It can also calculate using

Property Tax (k)=(G-I)*20%+Cess(24% of property tax)

G= Gross unit area value by x+y+z, I=G*H/100

The property tax is 20 % of total area property multiplied by per Sft rate fixed by BBMP for each kind of usage of property for ten months reduced by the depreciation allowed by BBMP Plus 24% cess on property tax.

BBMP Property Tax Online Payment

As discussed above, we can pay the property tax quickly from the online portal. You can also calculate the property tax easily within the website. Here are the steps which will help you make the payment soon form the site. BBMP Property Tax Paying online is simple and will help the people and save their time in paying the taxes. There is no need to wait in the lines at the offices and wait for the turn to pay property tax. BBMP property tax payment online is an easy and flexible way which is beneficial for both the government and taxpayer.

How to pay BBMP Property Tax

- Launch the website of BBM Property tax in your browser, which will open the home page on the screen.

- Now you can see the text window on the right side of the screen for SAS Property Tax Payment.

- Select the option of SAS or PID from the drop links available on the first text space.

- Enter the Base Application Number in the next text field and tap on the “Retrieve” button below the window.

- It will open the Form IV of your registered property on the screen and now check the details.

- If you want to change anything regarding the property like property usage, occupancy, or built-up area, then you can change here and click on Proceed.

- You will redirect to the Form V page and here check the pre-filled details and then make the tax payment.

- The BBMP Property tax payment is available in either installments or the full amount at a time. We can pay the taxes in both online or Challans.

- In the case you select the online payment, the page will redirect to payment mode selection like debit/credit or net banking.

- After the completion of the payment, the system will generate the receipt number, and you can print or download after a day of payment.

BBMP Property Tax Status

We can check the payment status through the online web portal of the page. Here in the below section, we will explain the process in the form of steps.

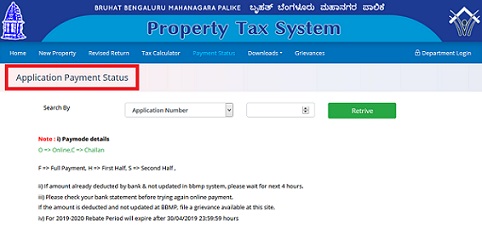

- Visit the official website form the browser of your device.

- You can search using Application Number or Challan and select the option form the drop list.

- Give the details in the form on the window and tap on Retrieve button on the page.

- The application payment status will display on the screen of the display.

- There are fee codes on display like “O” -online, C- Challan, F-Full payment, H-First Half and S-Second Half.

- If the amount is deducted from the bank account and not updated, then recheck the status after 4 hours of time duration.

- You can file the grievance to BBMP Property Tax if the amount is deducted and not updated in the website.

BBMP Property Tax Contact Numbers

We can apply for the grievance or give suggestions to the BBMP property tax online using the phone numbers. Here are the Address and Numbers are below.

- Phone Numbers:

080-2297-5555

080-2266-0000

- Availability: Mon-Sat, Except 2nd and 4th Saturday

- Timings: 10:00 A.M- 5:30 PM

- Email ID: [email protected]

- Office Address:

Joint Commissioner of Revenue,

NR Square, BBMP, Bengaluru

For more regular updates and information, check Timesalert.

Contents