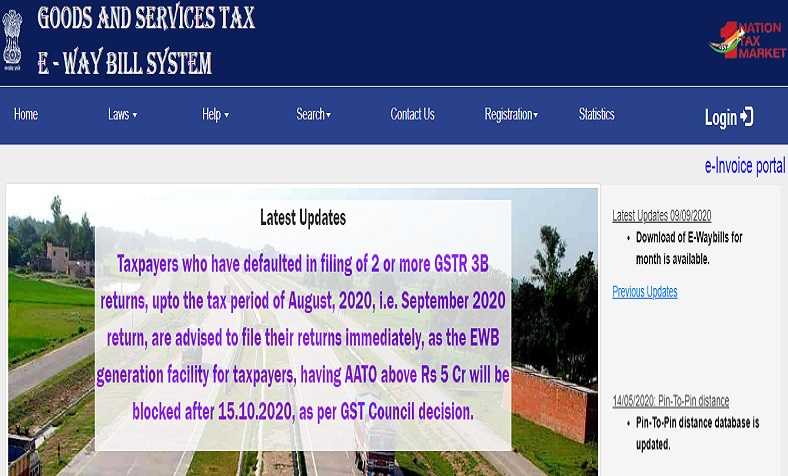

An E way bill an Electronic waybill for the movement of goods to generate on the e way bill portal. A person or company that registered under GST needs an E-way bill to transport goods worth more than Rs 50000 in a vehicle. That E-way bill generated on ewaybillgst.gov.in.

E-way Bill

An E-way bill can also be alternatively generated through SMS or Android App, on the generation of an E-way bill the customer is given a Unique E-way bill number (EBN). The number will be available to the supplier, recipient, and the transporter.

When is an e-way bill generated?

There are three instances in which an e-way bill has to be generated – mandatorily or voluntarily, they are:

- Generating an e-way bill is mandatory when the value of the goods that are being transported is more than Rs 50000, by a registered individual.

- For some specified goods, the generation of an e-way bill is mandatory, even if the value of goods is less than Rs 50000.

Such goods consist of –

- Inter-State movement of goods by the principal to the Job worker by the Principal/Registered Job worker.

- Inter-State Transport of Handicraft goods by a dealer exempted from GST registration.

- If any registered or unregistered individual wants to generate an e-way receipt for goods valued less than Rs 50000, then that is also possible.

Requirements for E-way Bill registration

- A Goods and Services Tax Identification Number (GSTIN), which is a 15 digit ID of the registered transporter or taxpayer.

- Registered Mobile Number of the GST system.

The registration process for the different kinds of taxpayers

Three different kinds of taxpayers or users, required to generate an e-way bill, at some point in their business. Every kind of user has a different procedure for getting registered in the portal.

- Registered person

Whenever a registered person trading goods worth more than Rs 50000, he required to generate an e-way bill, a bill can also generate for goods valuing less than Rs 50000 if the user wants.

If the registered receiver is getting goods from an unregistered supplier, then the former has to generate the e-way bill for the entire transaction.

- Registered Transporter/Taxpayer

On visiting the e-way bill portal, the homepage shows the option of “Registration” under which the user should click on “e-way bill registration”. After that, the user should enter their GSTIN and the captcha code and press on Go.

An OTP generated and verified. Once all the details entered correctly, a User ID and Password created.

kinds of taxpayers

- GST Unregistered transporters

Transporters carrying goods worth more than Rs 50000 by any means, be it air, road, water, etc. will also need to generate an e-way bill.

Since a transporter will not have a GSTIN, the concept of a Transporter ID has been devised. Every unregistered transporter will be allotted a Transporter ID, which they can use in place of a GSTIN in an e-way bill. For more updates check Timesalert.

With the help of the ID, the transporter can get a unique username to operate on the e-way bill portal.

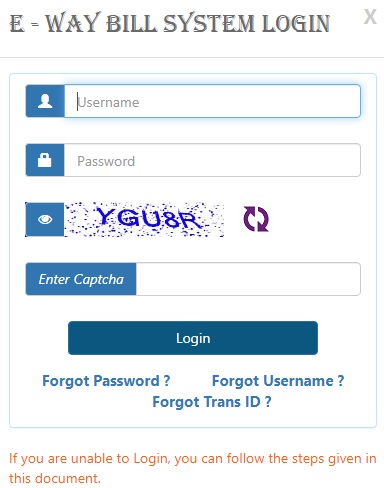

How To Login E-way bill portal

Users can follow a few easy steps to log into their e-way bill dashboard

- On a browser, open the e-way portal using the e-way link.

- User can enter his username and password and click on login to get into his way

- Username should be more than 8 characters and should not exceed 15 characters. It should contain – alphabets, numerals, and special characters.

- The password should also be at least 8 characters.

All the details about the E-way Bill login portal and registration steps clearly discussed above. So people can read the complete article and know about other details.

Contents