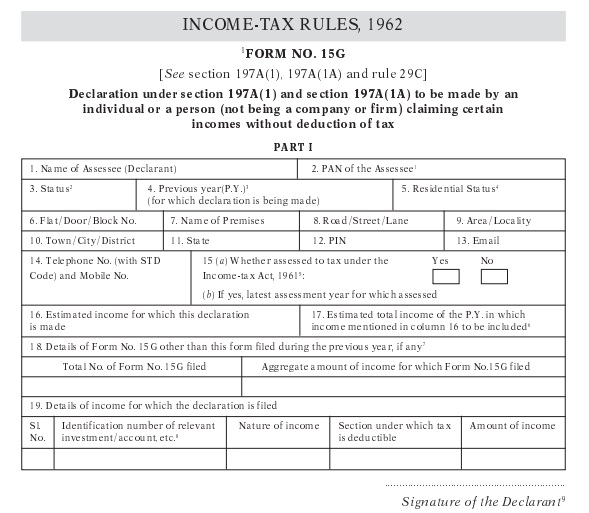

For all our different official purposes, the government of India has forms that cater to our administrative works. There are forms for getting a driver’s license made, pan card, and so on. One such form is the 15G. Form 15G is issued by the Income Tax authority of India, under section 197 A (1), 197 A (1A), and rule 29 C.

Form 15G

The form 15G means a declaration filed by Bank Fixed deposit holders who are aged less than 60 years and are not HUF. The reason for getting this form filled is to make sure that no TDS is deducted from their interest income from the fiscal. As per the Income Tax rules, banks are required to deduct TDS when interest earned on Recurring deposit or Fixed deposit is more than Rs 10,000 in a financial year.

In the Interim Budget presented by the government in 2019, this TDS threshold was increased to Rs 40,000 with effect from the financial year 2019-2020.

Features of the Form 15G

- The form 15G is a self-declaration form that seeks for deduction of TDS on specific income as an annual income of the tax assessee.

- All the rules with the Form mentioned in the provisions of Sections 197A of the Income Tax Act, 1961.

- 15G is required to be filled by citizens below the age of 60. Anyone above that age is counted as a senior citizen.

- The current format of the Form introduced by the CDBT ( Central Board of Direct Taxes)

- The format of the Form 15G changed in 2015 to make it simpler.

How to download the Form 15G

Form 15G format is easily available in many places. It can be downloaded for free from the websites of all major banks in India. Alternatively, the form can also be downloaded from the website of the Income Tax Department of the Government of India.

Eligibility criteria for filling the 15G form

Form 15G can only be filled by people who fulfill the eligibility criteria, as listed below:

- It should be an Individual or person rather than accompany or firm.

- The individual should be a resident Indian for the applicable financial year.

- The Individual should be of 60 years of age or less.

- Tax liability calculated on the total taxable income for the financial year will be zero.

- The individual’s total interest income for the financial year is less than the basic exemption limit.

How to fill Form 15G

After downloading the form from the above-mentioned websites, you can fill it up easily by following the steps we have compiled for you below:

Form 15G comprises two parts. The first section for the taxpayer to fill and the second part filled by the bank or financier. You only need to know the process of filling the first part:

- Write your name as mentioned in your PAN Card.

- A valid PAN (Permanent account number) mandatory while filling the form 15G online. If PAN details are not furnished then the form will be treated as invalid.

- The previous year should be selected as the financial year for which the individual is claiming the non-deduction of the TDS.

- You should also mention your residential address since Non-Resident Indian (NRI) is not eligible for filling the form.

- Mention your correct communication address as well as your pin code.

- Also, mention your working email id and phone number for any further contact.

- Tick mark, “yes” if you were able to access the tax as per the provisions of Income Tax Act 1961 for any of the previous assessment years. For more information check Timesalert.

- Mention the latest assessment year for which your returns were assessed.

- Details on estimated income (Total income for the financial year) should also be mentioned.

- If you filled the form 15G sometime in the past year, then aggregate income has to be mentioned.

- You also need to provide any investment details, such as investment account number, term deposit, insurance policy number, employee code among other things.

- After filling the form, you should check all the details once again to rectify any errors that could have been made.

- The second part of the form, as mentioned will be filled by the bank.

How To Submit Form 15G

After filling the form correctly, the assessee individual can submit the form online itself. According to the CBDT, the deductor will assign a Unique Identification Number for each self-declaration made by the taxpayer. You can submit the form through the bank’s net banking facilities, right after filling it.

Contents