GST is also known as a short form for Goods and Services Taxes. With its inclusion instead of the old tax regime, people benefit a lot. Because, through GST Registration, the Central Government has bought all the various taxes like VAT, SAT, etc. under one heading, that is GST.

If you were earlier a taxpayer, or you provide goods or services to people, then you mandated to file GST tax returns. If you provide services and your annual turnover of the business is Rs 20 Lakhs or more, then you need to go for GST Registration. Also, if you supply goods and your annual business turnover is above Rs 40Lakh then also you need to have GST Registration Number.

GST Registration

There are multiple forms of Registration under GST along with the business type associated with it:

- Casual: This registration category is for those business people who settle business on an irregular basis or informal manner.

- Composition: Suppose you live in a state A and you provide services to the residents of State B. In this case, you need to register for paying GST both in State A and B. This is the GST Composition.

- Standard: If you have a regular business setup and meet the criteria mentioned above, then you must register for GST.

- Non-resident: Any Non Residents of India who live outside the territory of India and provide goods or services to the residents of India, they shall require to register under this Non-Resident GST.

Documents Required To Get GST Registration Number

People who register for GSTmust have the following documents in hand:

- Applicant’s Aadhar Card

- Bank Account details like a blank cheque

- Proof of address

- Applicant’s PAN Card

- Applicant’s passport size photographs

- Authorization form

- Constitution of applicant

- Partnership deed if applicable

How To Apply For GST Registration Number Online

Follow these steps to know the GST registration process.

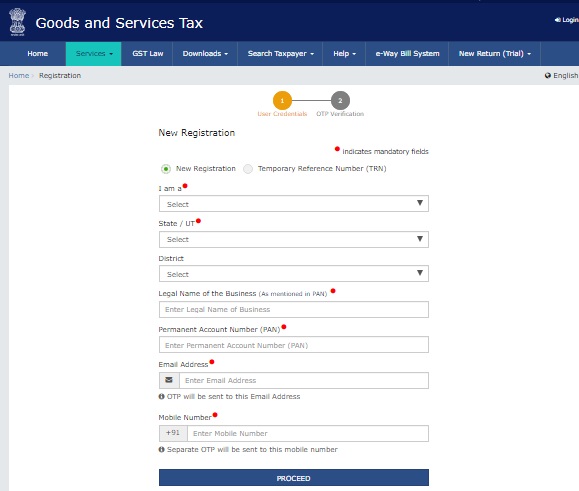

- Go to the official website of the GST portal.

- Navigate to the Taxpayer option and click on New Registration.

- Fill all the details. Once you submit your email Id and contact number, you receive an OTP on your registered mobile and email. Enter both of them in respective boxes.

How To Get GST Temporary Reference Number

- You see a Temporary Reference Number(TRN) on your computer screen. Take it down.

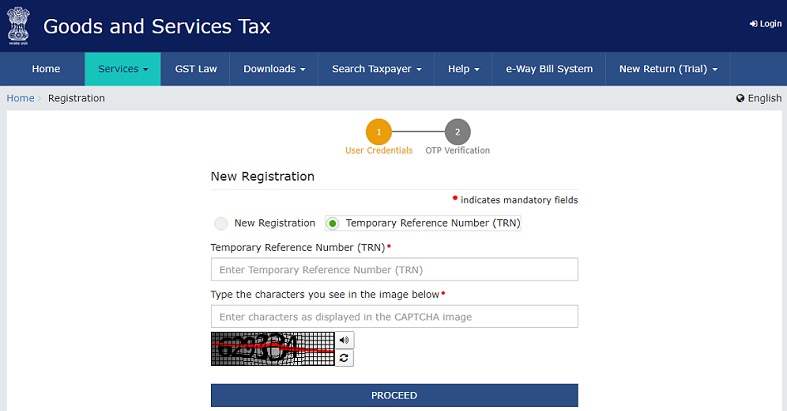

- Go to the homepage of the GST portal.

- Click on Register in the Taxpayers menu.

- Enter your TRN number along with the captcha code. Hit the Proceed button.

- Once again, OTP sent to your mobile and email. Enter it in respective boxes and hot the Proceed button.

- On the next page, you can see the status of your application. Click on edit to begin editing the application.

- You have to fill ten sections. Fill each of them and upload the necessary documents.

- Upon the next page, you have to verify your application. You can do so by:

- E sign method: For this, you need to have access to your Aadhar Card number and your registered contact number. For verification by Esign, you get an OTP on your registered number. Enter that OTP to verify and digitally sign your application.

- Electronic Verification: For this method, an OTP sent on the number through which you registered on the GST portal.

- Once the verification is thriving along with the form, you get the GST Application Reference Number on your email and registered number. By using the Reference Number, you can check the status of your application.

About GST portal

The Central Government, along with the launch of the new tax regime, has also launched a GST registration online portal. This portal helps the taxpayers to register themselves for paying taxes under the new scheme. They can also register for their eligible business entities. Using the portal, applicants can register and generate a GSTIN for the procedure.

GST Registration Charges & Penalty

If you delay in registering for GST, then you have to pay a fine of Rs 100 per day on each act. So you penalized both the state laws and central laws.

In case you do not register for filing GST you have to pay a fee which is equal to Rs 10,000 or 10% of the pending amount, whichever the court deems to be higher. Also, go through BBMP Property Tax Online Payment, and incometaxindiaefiling Login and get some details about it.

FAQs On GST Number

- Is there any GST Registration fee?

No, there is no such fee for GST registration by the government.

- Can an individual get a GST number?

Yes, any individual who has a business idea can get a GST number.

- Is it mandatory to have a GST?

Yes, it is compulsory to have a GST number as it is the tax paid to state and central government combine.

- What happens if I won’t pay the GST on time?

People who violate in paying the GST in time have to pay the penalties.

- Can we get GST Registration Process status once applied online?

Yes, the applicant can check their GST status online through the official portal.

GST Customer Service Number

If in any case, the user who faces any problem in paying the GST can contact through the customer support. So below is the contact number.

GST Help Line Number: 1800-103-4786

Final Words

GST has enabled the insertion of all the taxes under one head. It has resulted in regular taxpayers to pay fewer taxes on the services they avail. By using the information above, you can visit the GST Registration portal and register yourself. For more details, check Timesalert.

Contents